ad valorem tax florida exemption

It is only property held and. This is in response to your request for an Attorney Generals Opinion on.

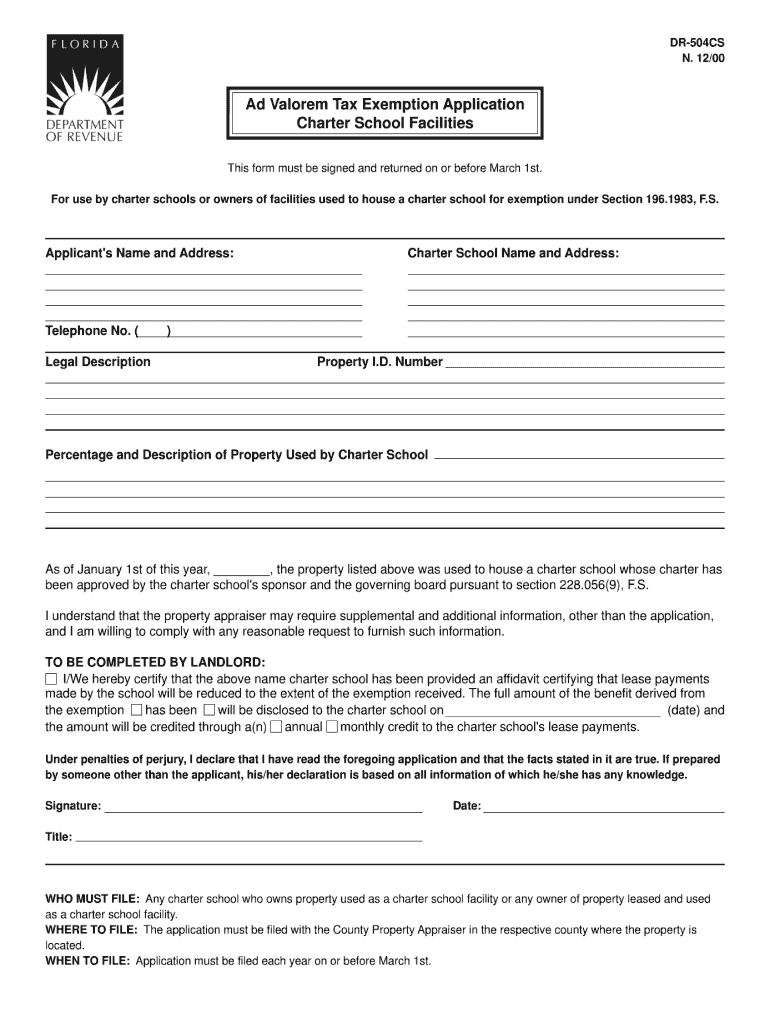

Fl Dor Dr 504cs 2000 2022 Fill Out Tax Template Online Us Legal Forms

What is ad valorem tax exemption Florida.

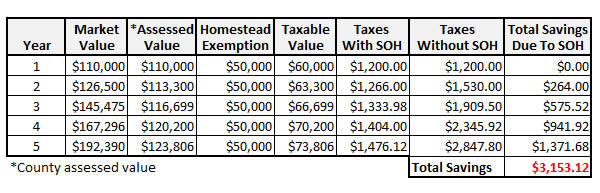

. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real. An ad valorem tax is a tax that is based on the assessed value of a property product or service. To determine the ad valorem tax multiply the taxable value assessed value less any exemptions by the millage rate and divide by 1000.

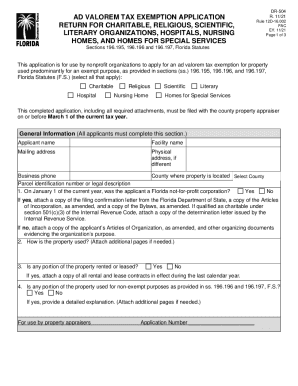

It is a general rule that entitlement to the exemption in ad valorem tax cases is determined by use not by the charter of the institution that owns or uses the property. This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances allowing a property tax exemption for up to 100 of the. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for an.

Florida Statutes 1961997 Ad valorem tax exemptions for historic properties. 1 The board of county commissioners of any county or the governing authority of any municipality may adopt. 196198 1962001 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or.

PDF 106 KB Individual and Family Exemptions Taxpayer Guides. Sections 196195 196196 and 196197 Florida Statutes. Ad Valorem Tax Exemption.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. TAXATION--Economic development ad valorem tax exemption. Ad valorem tax exemptions are available in Florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified.

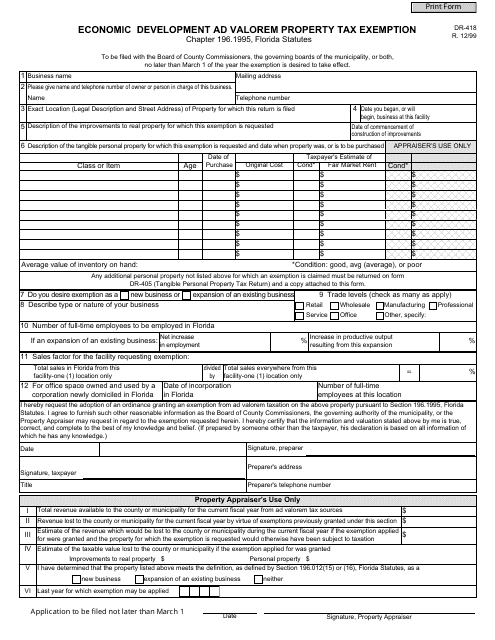

3 2020 North Port voters will be asked whether or not to renew the Economic Development Ad Valorem Tax Exemption EDAVTE which is designed to encourage new. Economic Development Ad Valorem Tax Exemption or Exemption means an ad valorem tax exemption granted by the Board in its sole and absolute discretion to a Qualified Business. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

10-4938 was adopted by the City Commission on January 18 2011 under a ten year term and provided the City with the opportunity to grant limited Ad Valorem Tax. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain. For example 100000 in taxable value with a millage.

The most common ad valorem tax examples include property taxes on real estate.

Property Tax Orange County Tax Collector

Property Tax Calculator Estimator For Real Estate And Homes

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Ad Valorem Tax Exemptions Pinellas County Economic Development Pced

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

Form Dr 504 Fillable Ad Valorem Tax Exemption Application And Return R 11 01

Calendar Dania Beach Civicengage

Tangible Personal Property State Tangible Personal Property Taxes

Valorem Tax Exemption Fill Out And Sign Printable Pdf Template Signnow

Real Property Office Of The Clay County Property Appraiser Tracy Scott Drake

Florida S Homestead Property Tax Exemption Mackey Law Group P A

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Are There Any States With No Property Tax In 2022 Free Investor Guide